delayed draw term loan vs revolver

Define Total Delayed Draw Term LoanExtended Revolving Credit Commitment. The draw period itself.

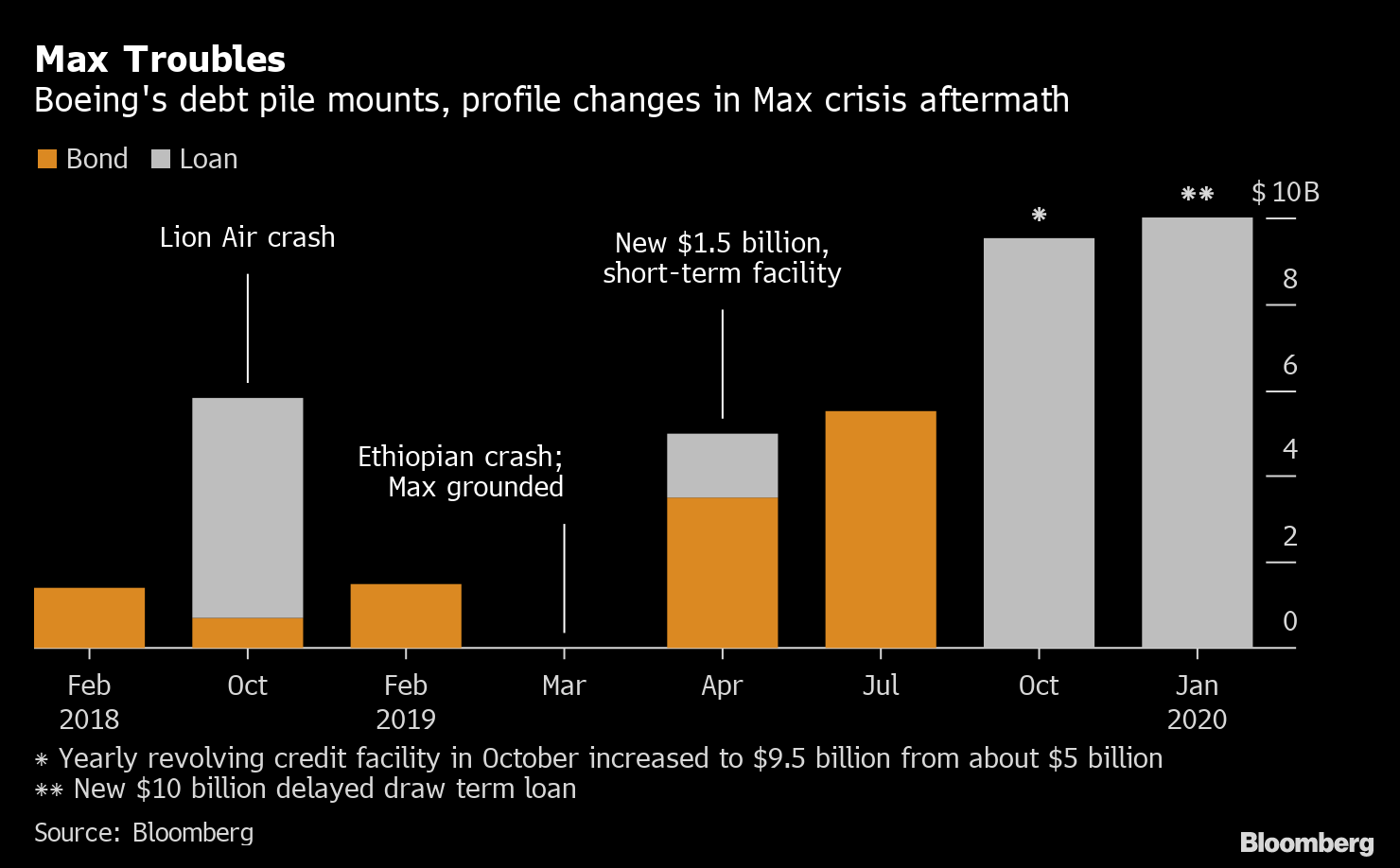

Boeing Shops 10 Billion Loan At Price Similar To Older Debt Bloomberg

Further negotiations may be around conditionality for the delayed draw and use of proceeds.

. Means any loan or other borrowing pursuant to which the holder may be required to make future advances to the borrower. It can also be a component of a syndicated loan which is offered by a group of. Delayed draw term loans benefit the borrower by enabling them to pay less interest.

Delayed Draw Loans and Term Loan. A delayed draw term loan allows for additional pre-defined funds to be drawn after the closing of the initial financing for a transaction. Excess Term Loans Delayed Draw Term Loans and Revolving Loans.

Define Revolving or Delayed-Draw Assets. Their appeal is one reason borrowers have moved. Unlike a term loan a revolving credit facility does not have a fixed repayment schedule.

Means the sum of the Delayed Draw Term Loan Commitments of all the Lenders. A revolving loan comes with a replenishing feature where the borrower can withdraw amounts and repay to fully utilize the facility again. These ticking fees start at 1.

A delayed draw term loan is a provision in a term loan that specifies when and how much the borrower receives. The increased use of the DDTL in the leveraged loan market is also driving longer commitment periods. Subject to the limitations set forth in this Section 205a the Borrowers may upon notice from the Borrowers to the Administrative.

The lenders approve the term loans once with a. A revolving loan is a set amount of money that an entrepreneur has access tolike a line of credit or a credit cardto spend when they need it and then pay it back plus any interest accrued. Autumn Sale 30 Off All Online Courses.

For example if you have a 10000 line of credit and need 3000 for production materials you will carry that balance and accrue interest while still. Benefits of Delayed Draw Term Loans. Related to Any Revolving Credit Loan Delayed Draw Term Loan Incremental.

A delayed draw term loan DDTL is a negotiated term loan option where borrowers are able to request additional funds after the draw period of the loans already closed. Best sustainable website design. The borrower only pays interest on the funds that are.

X The proceeds of any Term Loans made pursuant to subsection 21Aiii and Delayed Draw Term Loans and y the. Delayed draw term loan vs revolver. A revolving credit facility is a type of loan that allows the borrower to access funds up to a certain credit limit.

The borrower can then use these funds as needed and make payments as they are able. For example say you borrow 50000 and pay. This contrasts with commitment fees on revolvers of 50bp.

Delayed-draw term loans or DDTLs of up to two years are standard features of financing from private credit providers. The difference between term and revolving debt Term debt is a loan with a set payment schedule over several months or years. Term Loan C bears a current interest rate of LIBOR plus a spread.

Like revolvers delayed-draw loans carry fees on the unused portion of the facilities. Commitments and Contingencies General legal mattersOther than routine litigation incidental to our business or. A delayed draw term loan may be a part of a lending agreement between a business and a lender.

Facebook page opens in new window Instagram page opens in new window. DDTLs used to be available for three six or 12 months but the DDTLs in the recent deals are available for up to two years.

Angiodynamics Inc 2023 Q1 Results Earnings Call Presentation Nasdaq Ango Seeking Alpha

The Smilist Completes Debt Financing For Affiliation With Encore Dental Baird

Phoenix Ib Assists Polymeric Resources Corporation In Completing A Successful Refinancing Through Citizens

Keybanc Capital Markets Linkedin

Direct Lending Transactions Invesco Us

Debt Schedule Video Tutorial And Excel Example

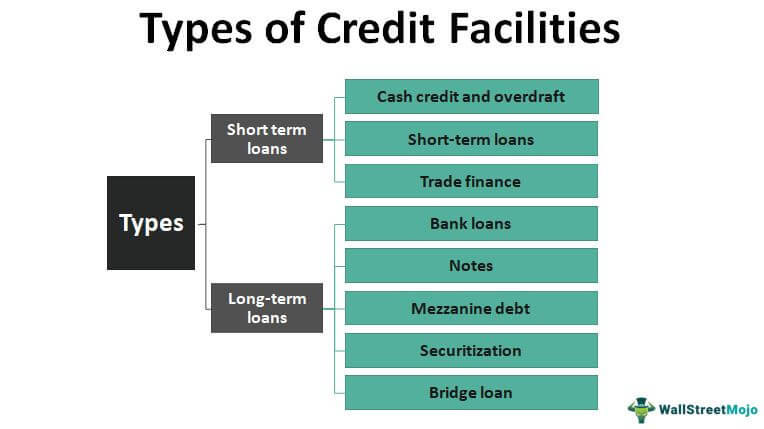

Types Of Credit Facilities Short Term And Long Term

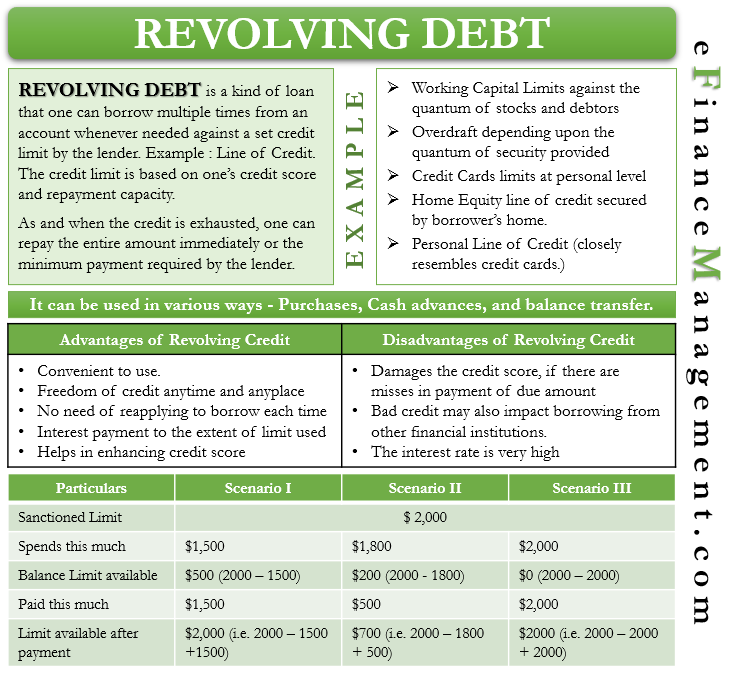

Revolving Debt Concept Significance Efinancemanagement

Holley Inc Announces New 825 Million Credit Facility

Update 1 Pg E S Revised Dip Facility Clarifies Minimum Asset Sale Sweep Threshold Term Loan Pricing Lowered Reorg

Leveraged Loan Primer Pitchbook

Tropicana Naked And Other Select Juice Brands 2 73 Billion Of First Lien And Second Lien Credit Facilities Cravath Swaine Moore Llp

Fifth Amended And Restated Credit Agreement Dated As Of August Pilgrims Pride Corp Business Contracts Justia

Sec Filing Capital Southwest Corporation

Revolving Credit And Term Loans As Credit Alternatives To Firms In Mexico When And For What Purpose

Houlihan Lokey Advises Jakks Pacific